Breaking the Bank

When George Soros “broke the Bank of England,” famously earning him $1.1 billion on a single trade, it was not only the Bank of England who was rocked by losses. Some ambitious and formerly successful traders had bet against Soros – traders such as Bob.

Some background: In 1990 the Britain's Thatcher government decided to join the European Exchange Rate Mechanism (ERM). The ERM was a system to reduce exchange-rate variability. With U.K. inflation at three times the rate of Germany's and interest rates at 15 percent, the conditions for remaining the ERM were not favorable.

Due to its inherent impossibility, as well as short-selling by an international group of currency speculators led by George Soros, the UK was forced to withdraw from the ERM on September 16, 1992 ("Black Wednesday"). Soros' trade was virtually guaranteed to be successful due to the large interest rate differentials between the U.K. and Germany. Not all central bankers learned the lesson - Soros and others profited from similar trades put on before the Asian Currency Crisis of 1997.

Sign up for newsletter at: MarketPsychData.com (Click "Contact")

The Yin and Yang of Bob

“Resentment is like taking poison and hoping the other person will die”

~ Anonymous (from Jeff Kober)

As a floor trader during the late 1980s and early 1990s in Chicago, Bob was considered one of the best traders in the commodity pits. But Bob was bothered by something. Being among the best commodity traders in Chicago wasn't enough. He resented that he wasn't yet recognized as one of the world's top traders.

Bob came from a family of traders, and success came easily for him. So easily that he often stayed out late after work - drinking heavily and playing poker with the guys.

When he first got wind of Soros' big bet against the British Pound, Bob was envious. Here was a world-renowned trader taking on a central bank. The gall of that proposition bothered Bob. It didn't matter whether Soros' reasoning was sound. Bob resented that another trader, one widely considered one of the best in the world, was doing something so big and bold. Bob thought, "I'm a great trader," and then a light bulb lit up - this was his chance to beat Soros at his own game and gain global fame.

Bob began placing large bets that the Pound peg would hold, and he developed a thesis about why this was a good idea after he had started placing the bets. As the peg held, the stress of the position nonetheless began to wear on him as more and more orders against the ERM peg - challenging the Bank of England - flowed into the Chicago pits. As if to bolster his own courage, he doubled the size of his bet, effectively calling this one trade as the make-or-break point of his career.

On September 16, 1992, Britain abandoned its adherence to the ERM, and Bob lost his entire net worth, his reputation, and his career.

Bob didn't take responsibility for the loss for several days. Instead he blamed the Bank of England. He sold his seat on the exchange to pay off debts but still did not have enough collateral.

Bob rapidly spent down his minimal savings, and his alcohol habit picked up. In September of 1993 he declared bankruptcy. Bob was hitting bottom - his behavior was erratic, he had lost all of his significant relationships. He was alone, depressed, resentful, alcoholic, and entertaining thoughts of suicide.

Emotional Ruts, Resentment, and Institutional Mistrust

“It is plain that a life which includes deep resentment leads only to futility and unhappiness. To the precise extent that we permit these, do we squander the hours that might have been worth while. But with the alcoholic, whose hope is the maintenance and growth of a spiritual experience, this business of resentment is infinitely grave. We found that it is fatal. For when harboring such feelings we shut ourselves off from the sunlight of the Spirit.”

~ The Big Book of Alcoholics Anonymous, p. 66

Personal resentment is a lot like institutional resentment and mistrust, and both are common among Americans scarred by the financial crisis. While the U.S. equity markets have rallied significantly this year, we're seeing investor money continuing to flow out of equities. The image below displays the cumulative outflows of investor money from domestic and global equity mutual funds based in the U.S. through mid-October 2012.

The loss of trust in markets, resentment of the 1%, and anger at bailed-out banks has left a generation scarred. And this public resentment may be driving the striking fund outflows. According to a recent Natixis survey, investors surveyed expressed fear about their financial futures, with fear “showing itself in such things as the 53 percent who say achieving stability in volatile times is their top priority…. Nearly one in four households (22 percent) with incomes of $500,000 or more believe most investments are a pure gamble [bold is mine].”

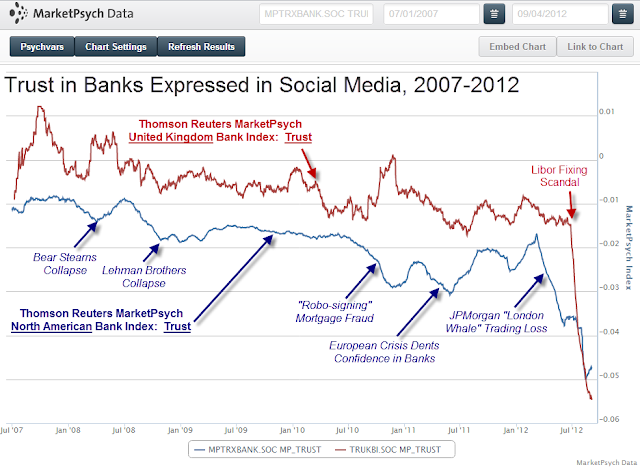

At MarketPsych Data we monitor trust expressed in various institutions, and our data show very low levels of trust in conversations about the financial industry. See the chart below for the long-term trust trend in our Thomson Reuters MarketPsych Bank index Trust data for both the U.S. and the U.K. You can see the gradual downward trend in trust since 2007 and that the Libor-fixing scandal sent trust in banks to all-time lows.

Fund outflows intensify during periods of declining trust, especially in 2012. Ironically, it is investing sharks (recalling last week’s newsletter) who don’t get hung up on the inequities in the system, rather they study it for what it is and look for advantages in the new order.

But most of us are not sharks, and we have emotional systems linked into our memories and feelings of mistrust. Performance slumps – like mistrust and resentment - are a type of emotional rut that we can fall into and have a challenging time climbing out of.

Whither Bob?

I heard Bob’s story after speaking about financial psychology at a technology conference. He pulled me aside after my talk. As he shared his story with me, I didn’t find his fall the most moving episode - it was the story of his redemption that struck me.

Bob methodically rebuilt his reputation and social network in the years following hitting bottom. Bob is today a very successful technology executive who has been sober for more than 15 years.

How did Bob implode his trading account, lose all his social support, destroy his reputation, become addicted to alcohol, hate the world, contemplate suicide, and ultimately recover? The secret to Bob’s recovery lies in the method that any of us – including nations – can use to get out of a slump.

We’ll go into more detail on the steps to climbing out of a slump next week…

Souring on AAPL and Buying the Disaster That Is AMD

In our short-term quantitative models we’re seeing a one week short signal on Apple (AAPL) – we have seen shorts on Apple for quite a few prior days as well due to disappointment about no new path-breaking products and increasing competition. We also see a “buy-the-disaster” one-week long on Advanced Micro Devices (AMD). Also seeing a mild one-week long on the S&P 500, indicating the market is slightly oversold. (See Disclaimer below).

Housekeeping and Closing

It has been a busy few weeks as we launch the Thomson Reuters MarketPsych Indices for monitoring market psychology. Please let us know if you’d like more information.

In the next month we will be speaking in New York, attending the Sentiment Analysis Symposium in San Francisco, and our Chief Data Scientist, Aleksander Fafula, is speaking at Predictive Analytics World in London.

We hope you found the letter this week interesting and useful!

Sign up for newsletter at: MarketPsychData.com (Click "Contact")

We have speaking and training availability. Please contact Derek Sweeney at the Sweeney Agency to book us: [email protected], +1-866-727-7555

Happy Investing!

Richard L. Peterson, M.D. and The MarketPsych Data Team

Musings about the latest happenings in the fields of investor psychology, behavioral finance, and neurofinance. We'll explain what the latest research means for you and your bottom-line.

Saturday, October 27, 2012

Saturday, October 20, 2012

Psychopaths at Hedge Funds, Google, and The Persistence of Bad News

The School of Life

As you may know, Google released negative earnings news on Thursday. The stock promptly lost 10% of its value, and many investors were left wondering what to do. Well, with news analytics technology, we now have a (short-term) answer. In this case, they should have sold Google in the short term.

Innovation at Google

Street craps – played with two dice on a sidewalk - is little like its casino brother. The odds are different, the pace is much faster, and your dealer is typically a hustler or worse, a psychopath. As for me, I learned how to deal street craps in prison.

As a psychiatrist I’ve evaluated competency and treated mental illness among prisoners, some of whom were hustlers or psychopaths. Street hustlers in my experience are usually quite engaging and reflective, able to gain insights and do productive psychological work. Psychopaths are cold and heartless – mimicking the emotions and social styles they have seen expressed by others. Typically psychopaths don’t see a psychiatrist voluntarily, and when they do, they spend a good deal of time looking for angles – how to game the system and get what they want from the doctor.

When a psychopath offered to teach me street craps in a prison, I knew from my clinical training that he was being friendly only because he wanted something from me - information, medications (some medications are used as currency in prisons), or to learn some therapeutic tricks he could use on others. Nonetheless I was riveted as he explicitly taught me how to spin the dice to get the numbers I wanted and how to tap and blow on them to distract unsuspecting clients. At the same time, I told myself, I was gaining valuable insight into the mind of a psychopath. After the tutorial -- and alas too late to do anything about it -- I realized to my horror that my pen was missing.

He wasn’t interested in passing time with some friendly banter or in gaining some psychological insights while he was teaching me how to roll the dice – the dice lesson was for distracting me while he swiped my pen.

Psychopaths at Hedge Funds

There are occasional press reports and academic articles that speculate that psychopaths – essentially, those who do not feel empathy – have higher investment returns and climb higher in the Wall Street hierarchy. Books such as Snakes in Suits and The Wisdom of Psychopaths, and articles like this Stanford University study reinforce that perception.

There are occasional press reports and academic articles that speculate that psychopaths – essentially, those who do not feel empathy – have higher investment returns and climb higher in the Wall Street hierarchy. Books such as Snakes in Suits and The Wisdom of Psychopaths, and articles like this Stanford University study reinforce that perception.

There are some limitations in these books and studies, but the basic premise is accurate - psychopaths do not process information about risk as others do, and they do not dwell in emotional ruts or have moral qualms.

In the markets, unlike in street craps, you may be playing against investing psychopaths, or computers trained to trade like psychopaths, without realizing it. If you’re going to swim with sharks, better to be one.

And it is true that a predatory mindset suits hedge fund managers well. They are rewarded for their curiosity about any advantage they can find, regardless of who is on the other side of the trade.

Saving Grandma Millie

Saving Grandma Millie

I know of two very human hedge fund managers

who prominently display large images of

sharks in their trading rooms.

Sharks are aggressive and ruthless, and presumably traders perform

better when reminded to think like sharks.

At the same time, sharks have a lot in common with psychopaths. In particular, sharks don’t get hung up about

morality, they are quick and aggressive, they don’t feel regret or wistful

nostalgia, and they don’t second-guess themselves.

But there is clear limit to the social virtues

of shark-like thinking. Remember “Grandma

Millie,” the fictional California grandmother who Enron

traders ridiculed because she couldn’t pay her power bills in 2000? Or when Wall Street was insolvent in 2008-2009

due to the excesses of shark-ish thinking at Bear, Lehman, AIG, etc... Currently the only cage for sharks on Wall

Street are weak legal boundaries and the annual bonus, which restrains

risk-taking to an annual cycle of risk-reward.

In order to improve Wall Street’s stability a

five-year bonus cycle with claw-backs in case of spectacular risk-taking

failures. And we need stiff punishments for financial crimes. In prison I was shocked to see prisoners with

life sentences for a series of small property thefts that didn’t hurt anyone

and whose stolen property value was less than $10,000. Yet traders who bankrupt banks serve no prison time and leave with prior

years’ bonuses in their bank accounts. Traders

need to be incentivized to think of the long-term, and take appropriate

risks within those parameters. Traders are sharks, and if we don’t

cage them properly, then we shouldn’t be surprised about the damage they cause.

Over the next few weeks our newsletters will

explore the traits of sharks we should seek to emulate in investing, as well as

those – more obvious - to avoid. The

letter also explores why these traits can be so lucrative by examining one of

the most repetitive market patterns – momentum

– which is driving the market’s recent highs (sadly, without most investors

participating). We go on to explore

research detailing the stickiness of emotions and slumps and how they prevent

us from pivoting rapidly, and we conclude with a discussion of tools and techniques to bring the

positive traits of a shark into our own investment decision making.

Google and the Persistence of Bad News

Google and the Persistence of Bad News

As you may know, Google released negative earnings news on Thursday. The stock promptly lost 10% of its value, and many investors were left wondering what to do. Well, with news analytics technology, we now have a (short-term) answer. In this case, they should have sold Google in the short term.

The following chart was prepared by

Jacob Sisk, Lead Research Scientist at Thomson Reuters. This was presented on Wednesday at the

Thomson Reuters News Roundtable in New York.

The Roundtable is a fantastic event with authentic discussions of the

real-life challenges to implementing sentiment based strategies. I will alert readers in advance next time it

is held.

Image

Courtesy of Jacob Sisk at Thomson Reuters.

As you can see in this chart, there

is a persistent decline in stocks hours following bad news. This excess returns scale with the negativity

of the news, leading to 40bps (0.4%) additional declines for negative news in

the top 95% of negativity.

We saw something similar with Google

(GOOG) on Friday. From Friday’s opening

price, GOOG dropped 100bps more than the Nasdaq100 in the subsequent 2.5 hours

after the open.

For longer term investors we see

evidence that fundamentally bad news, as we saw with Google, leads to

persistent declines over longer periods as well. (Our old fund’s trading signals were

triggered by Google’s bad news and had a five day short signal from the Open

Friday morning).

So how would a shark have

behaved? A shark would not linger and

wonder what to do, essentially under-reacting to the bad news. A shark would sell immediately and ask

questions later. And that is what news

trading algorithms were doing as well.

If you’re going to swim with sharks, it’s important to think and act

like a shark.

Innovation at Google

After this problem at Google, I went

back and looked at our perceptual data to see if investors in online social

media may have identified problems at Google.

Interestingly, the level of Innovation Perceptions about Google

plummeted dramatically in the month before the earnings release. See the following image, where the green line

is the average of innovation perceptions (discussions about innovativeness at

Google) in online social media, and the candlestick line is the GOOG stock

price. Despite the enormous rally in the

stock price over the past 3 months, online investors perceived a decrease in

innovativeness at Google.

We saw a similar disparity before

the decline of Netflix stock began. The

decline in Netflix was preceeded by a decline in innovation perceptions about

that company.

That said, I think Google is an

amazing company and nothing like Netflix on a fundamental level. Google is a bellwether for innovation,

despite the current setbacks. Nonetheless, herd perceptions drive stock prices in the short

to medium term, despite a strong long-term fundamental outlook.

Housekeeping and Closing

Housekeeping and Closing

It has been a busy few weeks as we launch the

Thomson Reuters

MarketPsych Indices

for monitoring market psychology. In the next month we will be speaking in New

York, attending the Sentiment Analysis

Symposium

in San Francsico, and our Chief Data Scientist, Aleksander Fafula, is speaking

at Predictive Analytics

World in London.

Regarding

past and current forecasts based on sentiment trending positive: we no

longer believe an Israeli attack on Iran is likely (Netanyahu faces too much

opposition within Israel), we believe the housing recovery will generally

continue in the U.S., the fiscal cliff will be resolved with lots of tension

but not much change to deficit spending, and equity prices will be higher in 6

months.

We hope you found the letter this

week interesting and useful! Our

newsletter will be moving to a weekly schedule, every Saturday, and will

incorporate actual forecasts over the next few weeks as our macro-economic

prediction software comes online.

We have speaking and training availability. Please

contact Derek Sweeney at the Sweeney Agency to

book us: [email protected], +1-866-727-7555

Recent Press

Press about the launch of our Thomson Reuters MarketPsych Indices:

“Thomson Reuters Wins Best Use of Social Media in Trading and Technology at Financial News Awards.” Oct 6, 2012. The FINANCIAL.

Michelle Price. Oct 8, 2012. Financial News.

Happy Investing!

Richard L. Peterson, M.D. and The MarketPsych

TeamTuesday, October 02, 2012

Plummeting Confidence in the Financial Industry

Another day, another fraud accusation at a major bank. Makes me want to put all my savings in bitcoin.

Here is a graphic depicting the declining trust in the U.S. financials sector since 2000. Note that it is relentlessly dropping.

Here's a chart of the declining confidence in US and UK banks based on a textual analysis of social media (from marketpsychdata). Looks like the financial crisis was just the beginning of the damage to banks' reputations.

This declining confidence bodes well for hard assets (real estate, gold, bitcoin, etc...). But it does not bode well for the financial system.

Happy Investing!

Richard

Subscribe to:

Posts (Atom)